API generator for optimal data communication

Usually, a lot of water flows down the Rhine before programmers get to the point where an insurance product has been converted into software within the framework of a Backoffice.

With Real-Access software users, it is not the programmers, but your own employees who are at the helm when an insurance product needs to come to life within the Backofice.

ONE WEBSITE

Customers see want to get insurance, find knowledgeable information about your insurance products through your own website.

Intermediaries also provide information and advise their customers in this way.

However, websites are not capable of communicating independently with the database of a computer system.

For that, a data communication line must be opened.

API

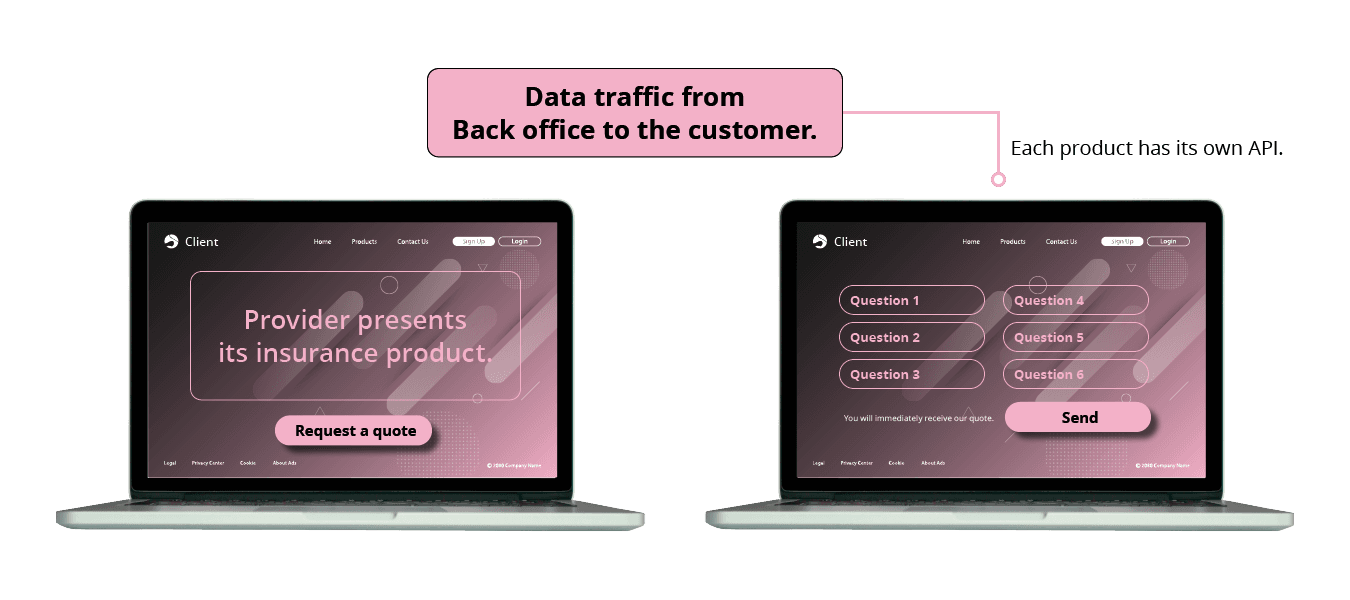

For communication with the database, an Application Programming Interface (API) must be available.

This API knows exactly where to find the required data.

If your website calls this API, a connection is established with the database. Data exchange can then take place. New data can be supplied. Existing data can be consulted.

Obviously, a Data set for capturing customer data, is set up differently from a Data set for buying a pile of wood or a pair of shoes.

In other words :

because each insurance product has its own specifications, a different Data set has to be created each time.

COMPLEX API

Commonly, an existing API is constantly extended with new data fields, so that the same Dataset can be used for all applications and products.

As a result, maintenance of the API runs the risk of malfunctions or errors in the system.

Dynamic API Generator (DAG)

Team RealXS has always taken the stance "What works that works and we won't mess with that anymore".

And so that is how we came up with the idea of providing our software with a generator capable of creating custom APIs independently for any application.

In other words :

Real-Access DAG generates its own API for each insurance product automatically and without the intervention of a programmer. This API can then be called by the insurer's or adviser's website. At least provided the website has access to the relevant API.

For promoting your products, Real-Access does not offer any services.

That is the supplier's job, which means it is you.

Contact with Backoffice

If the customer chooses one of your products or is advised to do so by his adviser, all it takes is a click on the link to the API to request a quote. The Backoffice then communicates with the website and the customer responds to the questions put to him from the Backoffice. After acceptance, the customer receives the quotation, a copy of the application form and an IPID.

Multiple quotes

In fact, the underwriting process is already underway while the customer answers questions.

The applicant may conceivably want to compare quotes. In that case, the applicant may wish to receive additional quotes of alternative products offered by the insurer after receiving the quote. This is possible, provided the underwriting process is uniformly set up.