Chain integration

"Developing a new vision is usually seen as a relay race in which members of your team take over from each other by mutual agreement. Each round takes time and time is money. With the introduction of its new software, RealXS makes it conceivable for the entire team to start simultaneously so that the time span required is reduced. As a result, maximisation of efficiency can be achieved within one round."

Joint interests of Insurers, brokers, advisers and customers within software finally put centre stage!

Just back in time

After automation became available to the business world in its current form in the 1976/1980s, insurers, stockbrokers, agents and intermediaries immediately realised the unimaginable possibilities that the use of screens could have for them. A tremendous efficiency gain was made.

Sharing each other's burdens

Historically, Direct Writers, Intermediary Insurers, Mediators, Advisers, Stock Exchange Brokers, Provincial Authorised Agents, Stock Exchange Assurers, Franchise Chains, Umbrellas, Service Providers and whatever else they may be called, all have an eye to organising the principle of "bearing each other's burdens". Some do so ism advisers, others provide administrative services, but either way there is a concept where administrative skills predominate.

Some work with Pools, others with Participations in Co-assurance, company policies, stock market policies, Lloyd's policies, domestic and foreign taxes and don't forget policies that are (have to be) expressed in other currencies and/or in other languages. All provided by Financial Service Providers who all have their own angle when it comes to insurance administration.

All double work and therefore not sustainable but inefficient and untidy. And the legislator regularly invents another inefficiency.

No Chain Integration!

Even though every computer scientist at the time realised that a solution would eventually have to be found for exchanging data, no one could have imagined that sending, receiving and processing data would become seriously difficult because every programmer had made his own choice about its design.

Example: The Weledelgestrenge heer Jhr. Mr. Johan M.K.L. van Stoethaspel tot Pieterburen.

How long can a name be? Do we register initials separately? Do we register the titles therein as well? Do we register the first name? The salutation? An address abroad?

Do we register a date as 'day, month, year' or 'year,month,day' or without mentioning the century?

So Chain Integration!

Since 1995, numerous excellent initiatives have been taken to make chain integration possible after all. Thick manuals explain what data is needed to provide a name or an expiry date, start date, end date etc. for the benefit of other systems. ASDN, ABZ, Meetingpoint, e-ABS/VNAB, DIN, DAK and hundreds of other services form the basis of a whole network of chain integration that also integrates initiatives such as FISH in bodies like the RWD and DIGID. In March 2011 - with the commissioning of the last phase of e-ABS - this process was effectively completed.

INSURANCE GROUPS

Insurers of today are no longer those companies of the past. On the contrary: in fact, insurance groups are no more than composite families within which a large number of parties have merged. Each party had and mostly still operates its own automation system. In most of these composite houses, you will find not only Direct Writers, but also intermediaries, consultants, authorised agents, franchise companies and insurance companies focused on working with intermediaries. This is not really conducive to the over-sightedness of the business within the group.

Innovation is in our blood

The family business Eurolloyd Insurance (v/h Lugt Sobbe & Co) has been a leader in numerous fields over the years and since 1835. Was the first broker to focus on cooperation with intermediaries. Was the first broker to take the initiative to function as a Postenbank. Implemented numerous innovations that have been adopted by almost all insurers. Think of how all insurers today have the degree of permanent disability assessed. To cover against perils like permanent disability due to illness, Unexpected guardianship, Damage due to snow pressure, Flood due to heavy rainfall, Creeping ice, Terrorism, Data related failures, Rain insurance for events and holidays in the Netherlands.

Software

In 1978, En was the first insurance house to produce its own software whereby intermediaries could be provided with services in the broadest sense of the word: Postenbank, Stock Exchange policies, company policies and policies taken out as authorised agent of Lloyd's Market and as authorised agent of numerous insurance companies in the Netherlands and abroad.

The right man in the right place

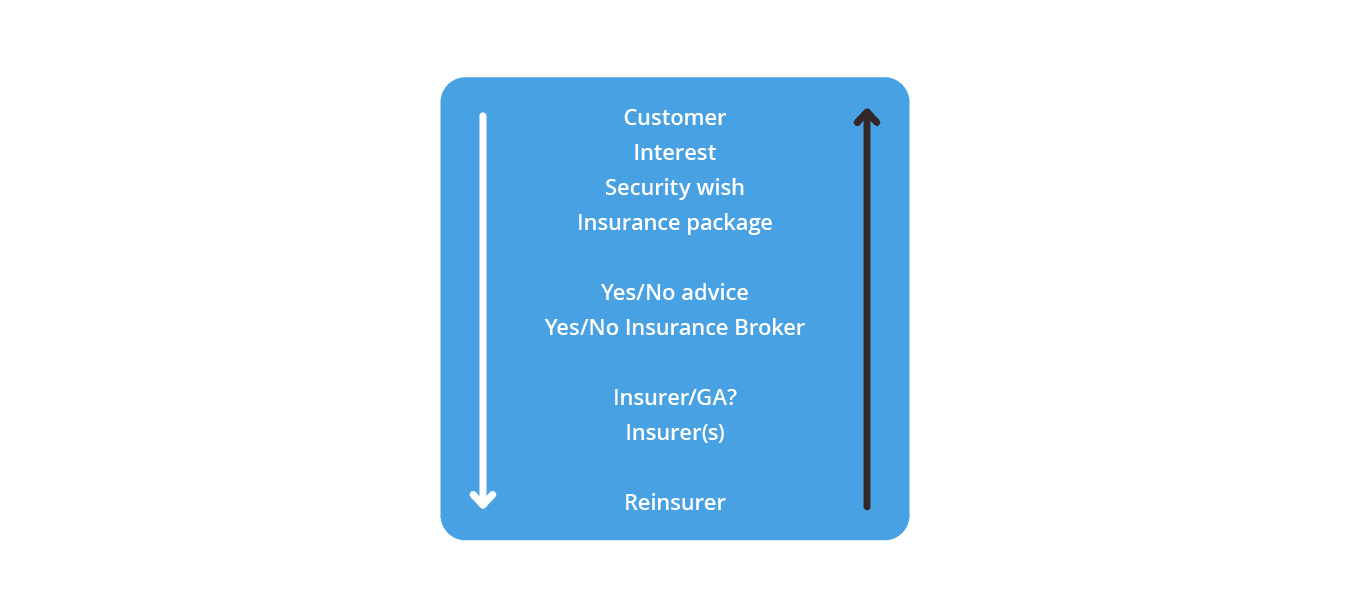

So data sharing is now possible. But isn't it time for a thorough evaluation? Has the point been reached where parties can make optimal efficient use of each other's services and efforts? Customers now also want to be able to arrange simple matters themselves. As the world is becoming increasingly complex as a result of National and International regulations, a timely start should be made to prepare for the next efficiency drive : the right man in the right place.

A new impetus

Surveying the battleground, it was obvious that - after the sale of Eurolloyd to Deltalloyd in 2007 - the way was open for taking an initiative. The team of software specialists that had already worked together at Eurolloyd in previous years then took stock of whether and, if so, what solution could be found for making the urgently needed efficiency improvements. In doing so, the bar was set high. As high as.

Efficiency, Transparency, Compliance, Communication

Corporate Social Responsibility

Taking responsibility and accepting the consequences : "Schowtime"

Policies covered by one insurer, Coassurance, Pools

Digital signature

Multi-lingual for employees

Multi-lingual for customers

Foreign risks, other currencies, other taxes

Every conceivable insurance product, linked to every conceivable underwriting protocol

Integral text processing where one text can be used multifunctionally for

any document.

Conversion, conversion

First of all, RealXS realised a platform that makes it possible to convert other data systems to the RealXS model. This system has already been applied twice and with 100% success.

RealXS = the user decides

Each insurer can decide for itself which lines of business it wishes to carry, which products it wishes to offer and up to what limits these may be accepted. Using protocols, intermediaries can do a lot of preliminary work for the underwriters. Advisors can use the product features generated by insurers to determine which product best suits the customer. It is not the price, but the product characteristics that are the primary determinant for making an advice.

Premium at least 20% down by working more efficiently

Provided parties run the relay at the same time, - even in a commission-free world - the balance of

- the net price of insurance products , plus

- the costs of intermediaries and advisers

be 20% lower than the gross premium currently payable for a lower-quality product.

But that does not apply to everyone

Because for those customers who use their insurance cover excessively often, a corresponding insurance package can be offered if required. RealXS is able to track these customers quickly so that insurers can also anticipate them in time by offering corresponding insurance packages.

And that, too, is good news for other customers.

Marketing to customers

Your news items are sent exclusively to relevant target groups within your customer relations: these are easily prepared and selected via smart routes that you can generate yourself.