Co-assurance Provincial

Some intermediaries have specialised in serving specific target groups.

Think of SMEs such as Bread Bakers, Restaurants, Sportsmen, the Film Industry, Company Collective Buildings, but also Classic Cars, Doctors, Events.

Such specialised insurance products are usually not offered on the Exchange because the insurance conditions are not standard (standard=exchange policies). These are insurance products developed by insurance consultants who have specific knowledge regarding the interests the target group would like to insure.

Small cases

Sometimes the interest is so small in size that one insurer is willing to take care of the risk coverage.

The adviser then creates the policy and the insurer signs the contract.

Large interests: Co-assurance Provincial

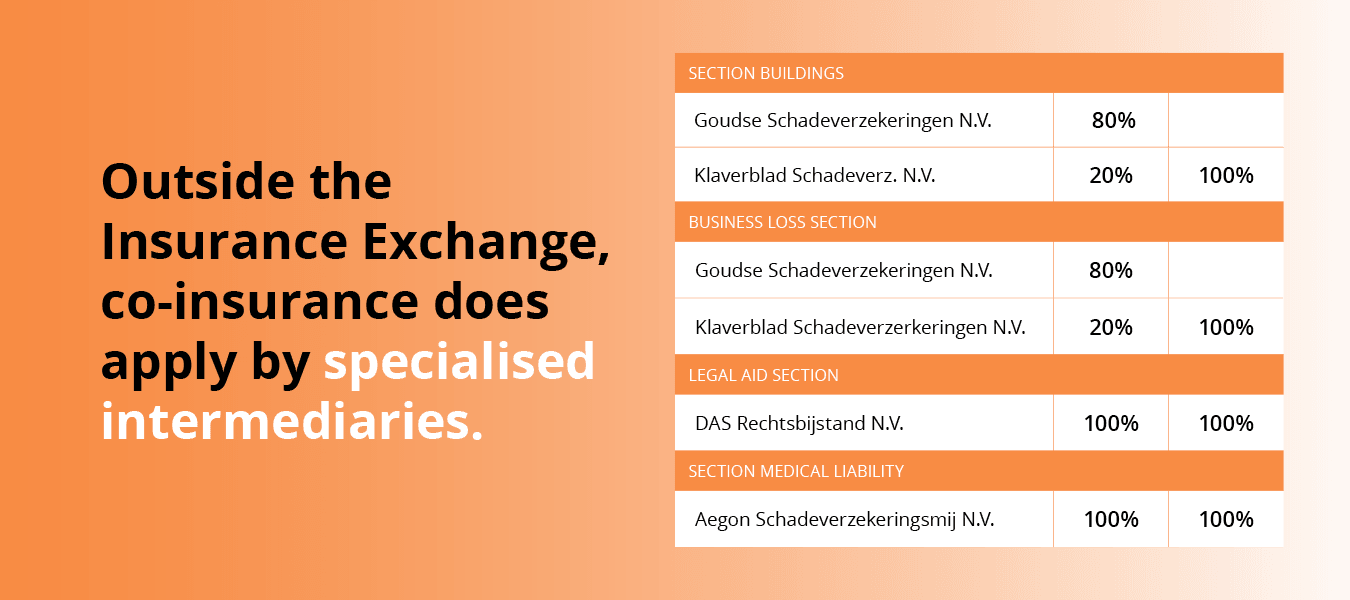

But if it is frequent that the size of the interests to be insured need to be covered from several insurers, then it is not unusual for the specialist adviser to put together a standing POOL of insurers who are interested in providing this insurance cover usually together.

Co-assurance

The policy formatting, financial settlement and such matters then require the intermediary to have specific administrative decisiveness.

Solved with realXS

The names and shares of the insurers are then mentioned on the policy.

And the insurers individually sign for their share or have it done digitally by RealXS software. The latter is only possible if it is certain that an underwriter of the insurer has agreed to digital signing.