Real-Access and the modern pension system

Traditionally, it has not been clear to business and policyholders what happens to pension assets. What are the returns? How do mortality gains and mortality losses affect the pension.

Below the red line: the amount of savings deposited.

Pension agreement: a more transparent and personalised pension system.

Together with employees' and employers' organisations, the government has concluded a pension agreement with new agreements on pensions and AOW. These agreements should make the pension system more transparent and personal. Such as:

Better pension agreements for early retirement for people with heavy workloads

Plans for compulsory disability insurance for the self-employed (AOV)

Much has changed in our society in recent years. The demography, economy and labour market are different. People are getting older and older. There are fewer working people compared to retired people. People no longer work all their lives with one employer, but change jobs or go into business more often. To adapt the pension system to this, the government has concluded a pension agreement with employees' and employers' organisations with new agreements on pensions and state pension.

The new pension system ensures that pensions can be increased more quickly when the economy is doing well. Pensions can also be reduced when the economy is very bad, although several mechanisms have been built in to prevent this. For instance, there will be a solidarity reserve to absorb losses and reductions can be spread over several years. Also, the new rules make it clearer what you accrue and the rules are more in line with the fact that people no longer work for 40 years with one employer. At the same time, the solidarity elements of the pension system are preserved: pensions are built up together and the risks are shared.

Effective date of new pension rules

The Senate will vote on the proposal for the Future Pensions Act on 30 May 2023. This bill regulates the legal framework of the new pension system. The law could then enter into force on 1 July 2023. Once the law is in force, trade unions, employers and pension providers will have 3.5 years to adapt pension schemes to the new legislation, until 1 January 2027.

The House of Representatives approved the Future Pensions Bill on 22 December 2022, including the adopted amendment proposals from the House of Representatives. Minister Carola Schouten sent the Amendment Bill Future Pensions Act to the House of Representatives on 30 March 2022.

The law governing the slower rise in the state pension age has been in force since 1 January 2020.

The intended pension system demands quite a bit from the government and from pension providers!

Especially in the area of transparency, there is much to improve. But organising a digital solution where the size of the individual pension pot can be shown on an individual basis makes it necessary to be able to account for things like :

* the management costs relating to the investments

* the impact of mortality gains/losses

* overhead (incl. intermediation, information, marketing and processing costs)

It is understandable that savings deposits made in 1983 have to be managed for another 40 years. So that either comes at the cost of returns, unless these costs are charged upfront.

On the other hand, a savings premium deposited in 1983 will be able to return longer than a savings premium deposited in 2003.

Meanwhile, incomes rise and so do premium payments.

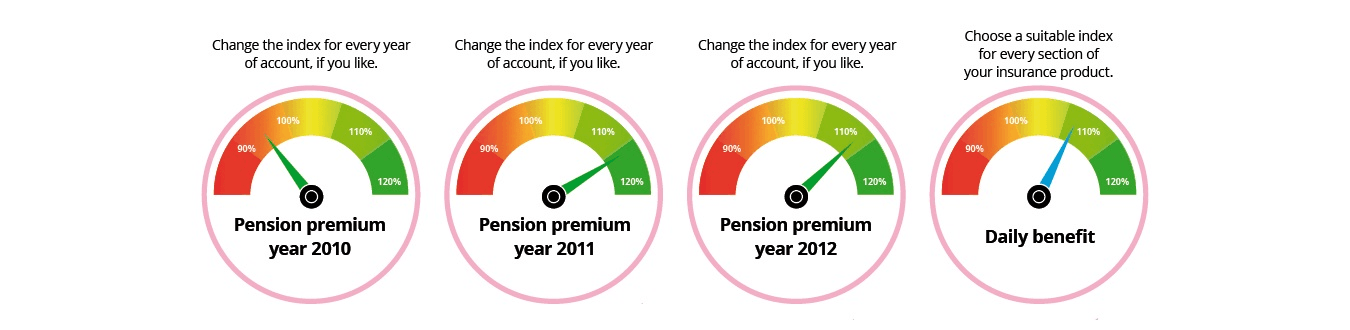

Thereby, it is conceivable that - in consultation with the saver - the way in which the savings are invested is determined from year to year.

One could then choose:

* indexed investment

* investing in a fund specialised in sustainable investments

* investing in bonds

* investing in gold and diamonds

* investing in the digital industry such as ASML / Apple

etc.

Obviously, such an approach must then be able to be processed digitally.

The new software uses a computing centre, where all data are processed.

This results in huge savings, especially for intermediary insurers, as the intermediary uses the same system.

The big question now, of course, is : is this system capable of applying the new pension system in the way described?

After all, nothing was known about this system when the software was written.

We submitted this question to Real-Access and the answer is a resounding YES.

If a pension insurer wants to be able to show what return it has realised with regard to the savings balance of a particular year, this is no

any problem.

If a pension insurer can calculate the management costs in advance, then it is no problem for Real-Access to charge these costs separately.

And the same goes for overhead.