Crucial infrastructure of banks, insurers and government agencies is threatened by shortage of IT staff.

Published earlier on Findinet Newsservices for the Insurance Industtry:

Copyright : Newspaper Financial Daily (FD)

By : Sandra Olsthoorn and Rutger Betlem

The FD published the following news item on 17 January:

An estimated 80% of Cobol programmers will retire in the next five years.

Crucial infrastructure of banks, insurers and government institutions is threatened by a shortage of IT staff. These institutions work with such an old programming language that it is still hard to find experts who can handle it. Experts advise organisations to take the problem seriously soon.

A shortage of specialised IT personnel threatens the continuity of services provided by banks, insurers and government institutions. Systems that regulate payment transactions, pay out benefits, process income taxes and payroll records at former state-owned companies, among others, are often written in the Cobol programming language, which is more than 60 years old. Few still have a grasp of it, while many specialists will retire in the coming years and there is hardly any new recruitment.

Over the years, the software has become so outdated and interwoven with critical processes that switching to a system in a different programming language is no easy task. And if an organisation embarks on it at all, it is often a years-long process, with high costs.

Over the years, the software has become so outdated and interwoven with critical processes that switching to a system in a different programming language is no easy task. And if an organisation embarks on it at all, it is often a years-long process, with high costs.

'That complexity of systems is a silent killer,' says professor Jurgen Vinju, who researches software transformations at the Centrum Wiskunde & Informatica (CWI). 'Compare it to a bridge you don't maintain. As long as you can cross it, nothing seems wrong. But if one day it's suddenly open, things do get complicated.' 'There is a spaghetti of code to untangle,' Vinju explains.'But the people to do that are becoming increasingly scarce.'

DISASTER ON ITS WAY

Many institutions are struggling to find a solution to the problem, experts observe. 'The sense of urgency is lacking,' says Matthijs Jansen of Cobol training provider Quuks. 'Cobol is seen as a cost item and not part of a bank's core. We see a disaster coming. You haven't solved the Cobol problem overnight.'

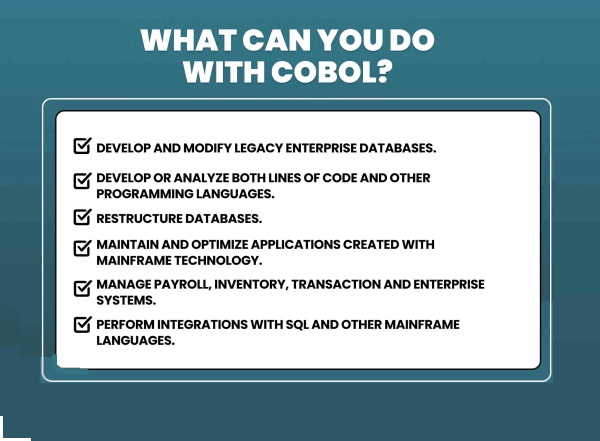

The biggest stumbling block is not the technology - which for certain applications, such as processing large amounts of data quickly, is sometimes even better than newer programming languages - but the lack of experts. Jansen estimates that 80% of Cobol programmers will retire in the next five years. And hardly any new ones are coming in: since the arrival of new, shorter programming languages in the 1980s, Cobol has had an old-fashioned image, universities and colleges stopped teaching it.

Companies and institutions face the difficult choice of replacing software written in Cobol or renewing their systems and trying to reduce complexity.

ABN Amro bank opted for permanent system development. An extensive job, says Dennis Kornet, responsible for the IT of critical payment systems at the bank. Anyone who still has to start revamping Cobol now is actually too late, he says. There is so little talent available that ABN Amro relies heavily on Indian IT experts, in addition to internal staff.

"HEADY JOURNEY"

Nationale-Nederlanden struggled to gather 20 Cobol experts when it decided to quit that language in 2021. Some came back from retirement to do the job. 'Maintaining the system became too expensive,' says project leader Jeroen Bos, who looks back on an intensive process. By choosing very carefully, the switch was completed in two years. What helps is that the insurer, unlike banks, does not have to settle its transactions in milliseconds and could therefore choose other programming languages.

Cobol is also ubiquitous at government institutions, such as the Tax Administration. Which, State Secretary of Finance Marnix van Rij had to admit to the House of Representatives in early 2023, had no more room for policy adjustments. All capacity goes to renewing the ICT infrastructure. The department is phasing out Cobol. 'A process of many years,' said a spokesperson. Internally, the service is training employees to become specialists.

GLOBAL PROBLEM

'Institutions look up to the efforts of phasing out. The downside risk is high. It'sa trade-off of how much risk are you willing and able to take.' Both continuing with Cobol and quitting it are seen as risky.

De Nederlandsche Bank states that financial institutions themselves are responsible for managing the risks regarding ICT systems and taking appropriate measures. Every year, the regulator reviews whether the risks have been adequately identified. 'In doing so, we also make specific enquiries about potentially obsolete systems,' the spokesperson reveals.

MONDIAL

'The shortage of Cobol programmers is a global problem. But because the Netherlands embraced the digitisation of administrative processes earlier than other countries, there is much more code to clean up,' says Vinju. 'As a result, we soon have 10 years of extra code we need to do something with.' Next Thursday, representatives from the financial sector and the government will talk at CWI about how to tackle the Cobol problem.

'The issue is not hopeless,' Vinju stresses. 'Cobol is not a complicated language, so, for example, there are great career opportunities here for re-entrants. We are also working on techniques to be able to analyse Cobol code automatically, which can make cleaning up systems easier. But there is a rush.'

So much for the FD publication.

——————————-——————————————————————————————————————————-

OpenC Computing Centre uses Assurance software from RealXS (Real Access), said director Remco van Buren.

OpenC Computing Centre uses Assurance software from RealXS (Real Access), said director Remco van Buren.

Real-Access Assurance Software has a long history, having worked on it since 1977 based on the languages common at the time.

Real-Access decided two years ago to convert the entire software to a modern language, guaranteed to be maintained by the new generation of programmers. "The new system contains the same functionalities as the old version," he says.

TOTAL RENOVATION

TOTAL RENOVATION

Just last month (December), the finishing touches were made to this total renovation.

The first customers were transferred to the new platform in January and the conversion went smoothly. The ease of use is significantly better and clearer, though.

AT THE HELM YOURSELF

"Real-Access software is specifically characterised by the fact that the user is directly at the helm, where setting up insurance products is concerned.

For the installation of insurance products, no IT assistance is needed after operation, because the software can be controlled by anyone who understands the insurance product." SELF SUPPORTING

SELF SUPPORTING

With Real-Access, setting up the product, the application process, robot acceptance, tailor-made acceptance, production of policy documents, invoices and claims handling are tasks that can thus simply be carried out by users within a span of a few days. Authorised agents as well as intermediaries can use this software to market products in cooperation with other intermediaries and, if desired, on a co-insurance basis. Settings relating to insurance tax and financial administration are then made fully automatically, as are all other matters mentioned. Sub-administrations for clients, cooperating intermediaries, insurers, experts and third parties (counterparty) are a standard part of real-access software.

Settings relating to insurance tax and financial administration are then made fully automatically, as are all other matters mentioned. Sub-administrations for clients, cooperating intermediaries, insurers, experts and third parties (counterparty) are a standard part of real-access software.